WV “homeschooling” is currently home-based, privately funded, and parent-directed. Homeschooling is a reserved term in WV code for those schooling under exemption 18-8-1 (C)2 – as differentiated from those receiving public funds through the Hope Scholarship.

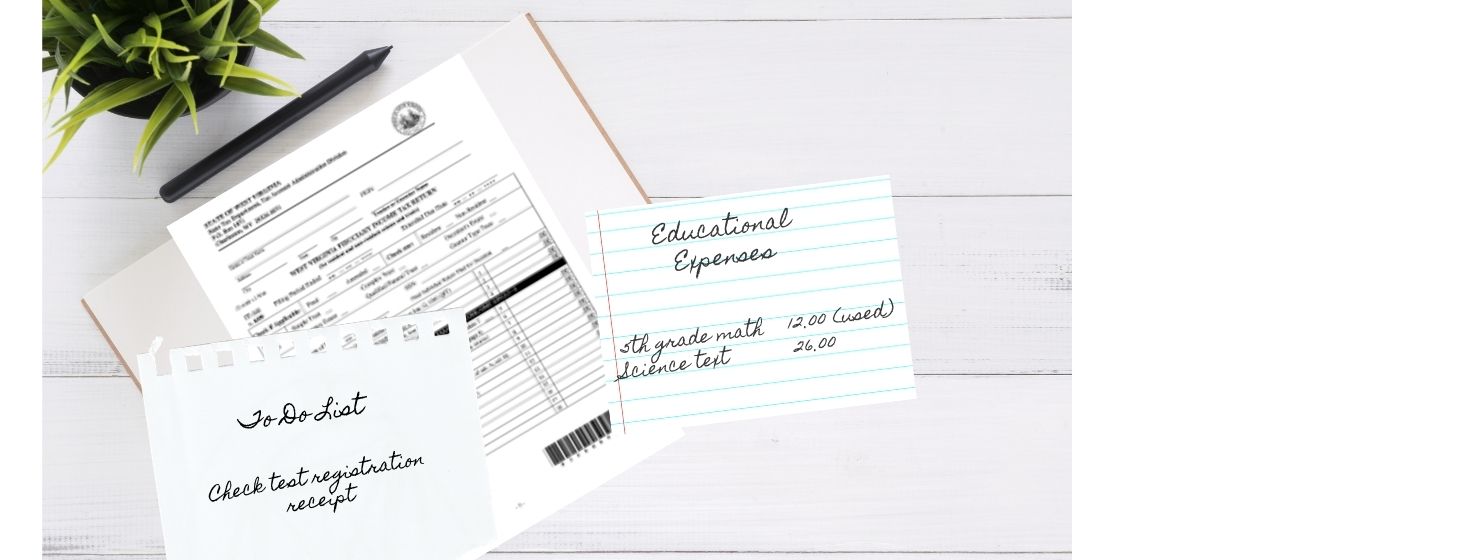

As an alternative to ESA Hope funds, tax credit legislation is the best way to provide financial help to homeschoolers. Claiming school expenses as tax credits provides relief to parents who are seeking alternative education but burdened by the personal expense. Yet it is not likely to invite further regulation as public funding often does.

Tax credit legislation has been introduced in WV Legislative Sessions for several years, but has yet to gain momentum in either house. With more support, that could change.

If you are a tax credit proponent, feel free to contact HSLDA or hsdc@chewv.org to find out how you might help.

Recent Comments