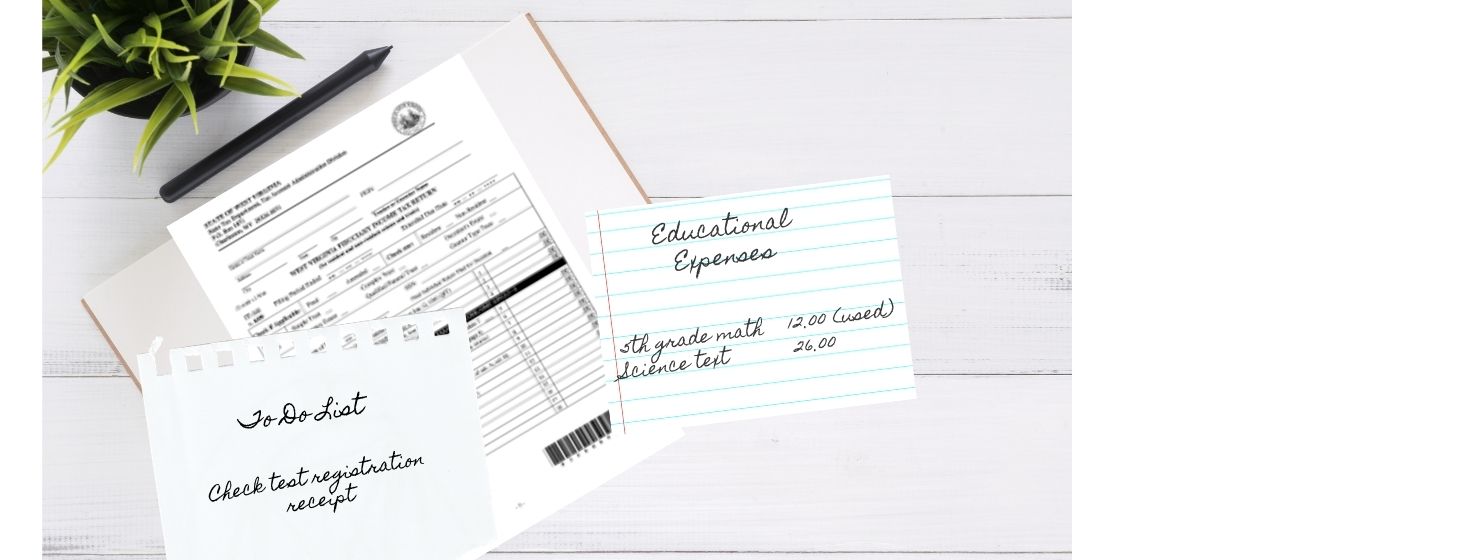

WV homeschooling is currently home-based, privately funded, and parent-directed. Because homeschoolers do not receive public funds, tax credit legislation is the best way to provide financial help to homeschoolers.

Claiming school expenses as tax credits would provide relief to parents who are seeking alternative education but burdened by the personal expense. Yet it would not invite regulation – which inevitably follows public funding.

Tax credit legislation has been introduced the past several sessions, but has yet to gain momentum in either house. With more support, that could change.

As the 2022 WV Legislative Session approaches, please remain involved in the process by staying abreast of the discussion and praying specifically about homeschool-related bills.

Recent Comments